EcoAsset.AI

Data Platform for Next-Generation Treasury

Asset Management

Asset Management

Transform your asset data into ESG impact — reduce regulatory risks, optimise asset pools, and lower operational costs.

EcoAsset.AI is a modular, customizable data

platform designed for bank treasury and asset management teams. It enhances data quality and transparency across loan and asset portfolios

(incl. structured finance investments), enabling ESG compliance, personalised green lending, and risk-optimized pool management and monitoring.

Regulatory Compliance

Navigate EU Taxonomy/Green Asset Ratio (GAR), CRR/CRD, CSRD and EPBD with confidence.

Capital and Funding

Optimise capital efficiency by improving asset classification and mitigating risks. Enable green bonds and simplify covered

bonds issuance, unlock access to cheaper funding and broader investor base.

Operational Efficiency

Increase automation and reduce errors. Streamline ESG and risk reporting for internal teams, regulators, rating agencies, and investors.

EcoAsset.AI offers a modular customizable approach to address your business needs

Module 1

Sustainability data retrieval & digitalisation for mortgage loans

Module 2

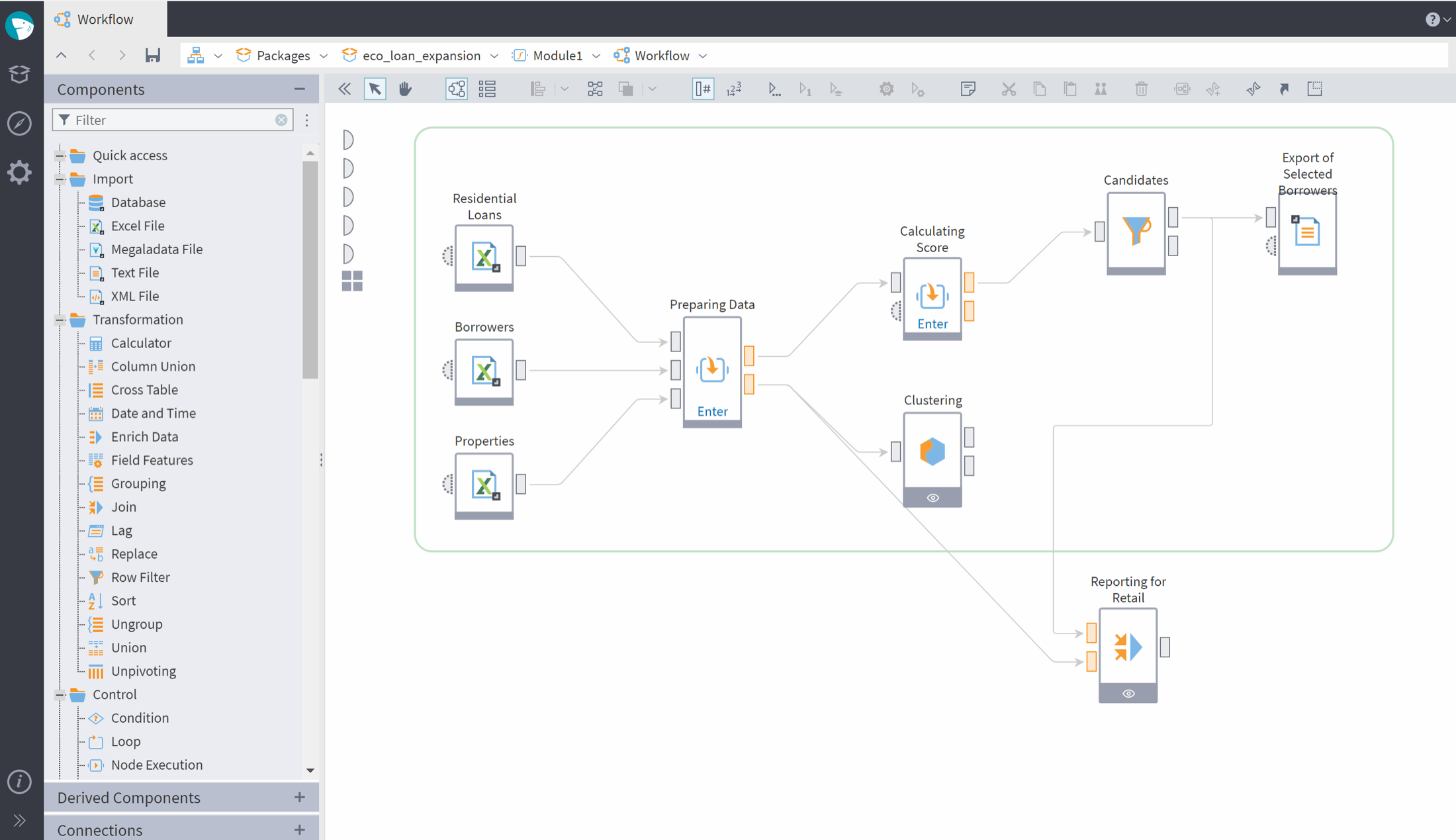

Borrower segmentation and sustainable loan top-up intelligence

Module 3

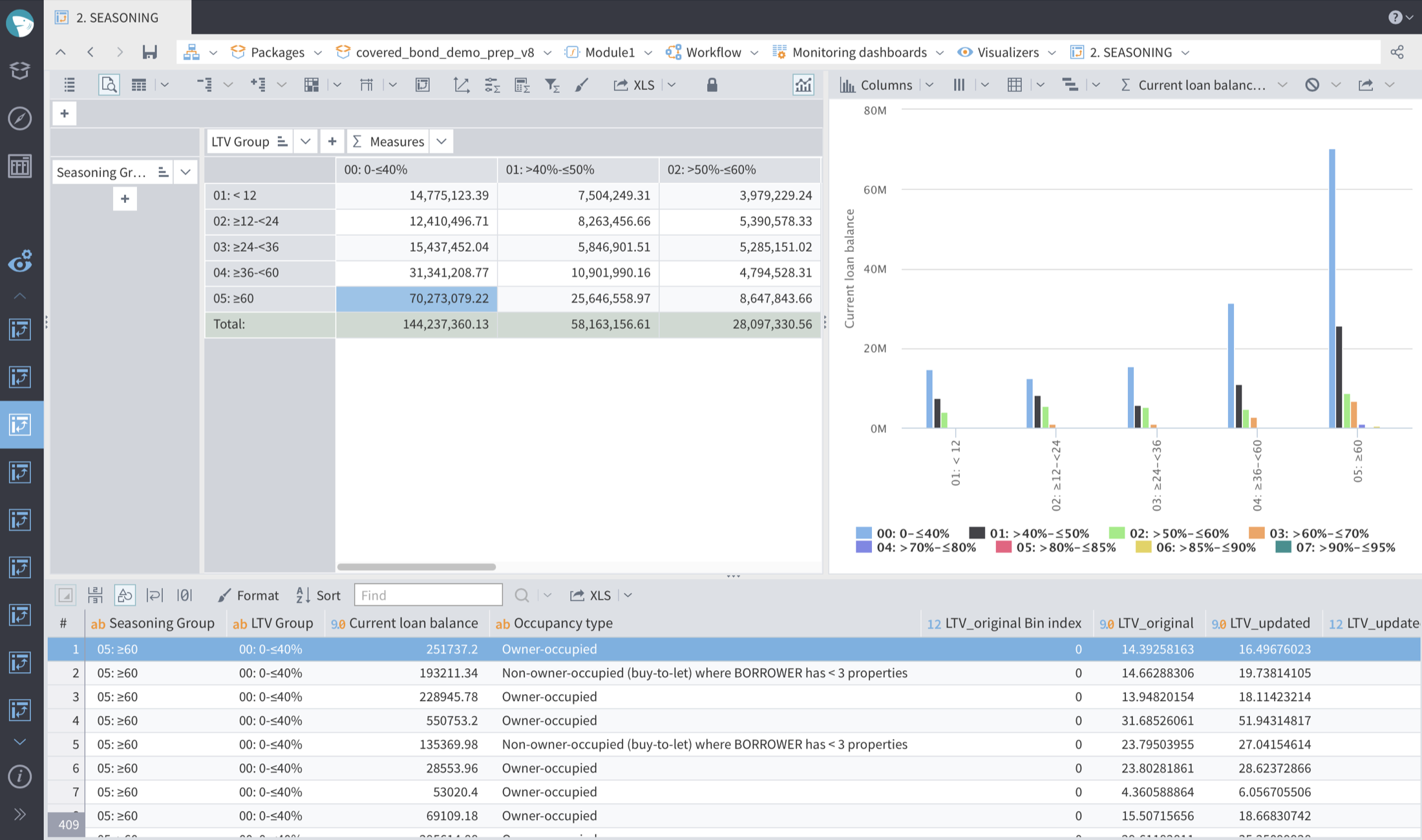

Daily cover/collateral pool management — selection, expected loss analysis, composition optimisation

Module 4

Tracks securitised asset pools across multiple transactions and asset classes (e.g., RMBS, ABS, ABCP)

EcoAsset.AI

Modular Data Platform for Next-Generation Treasury Asset Management

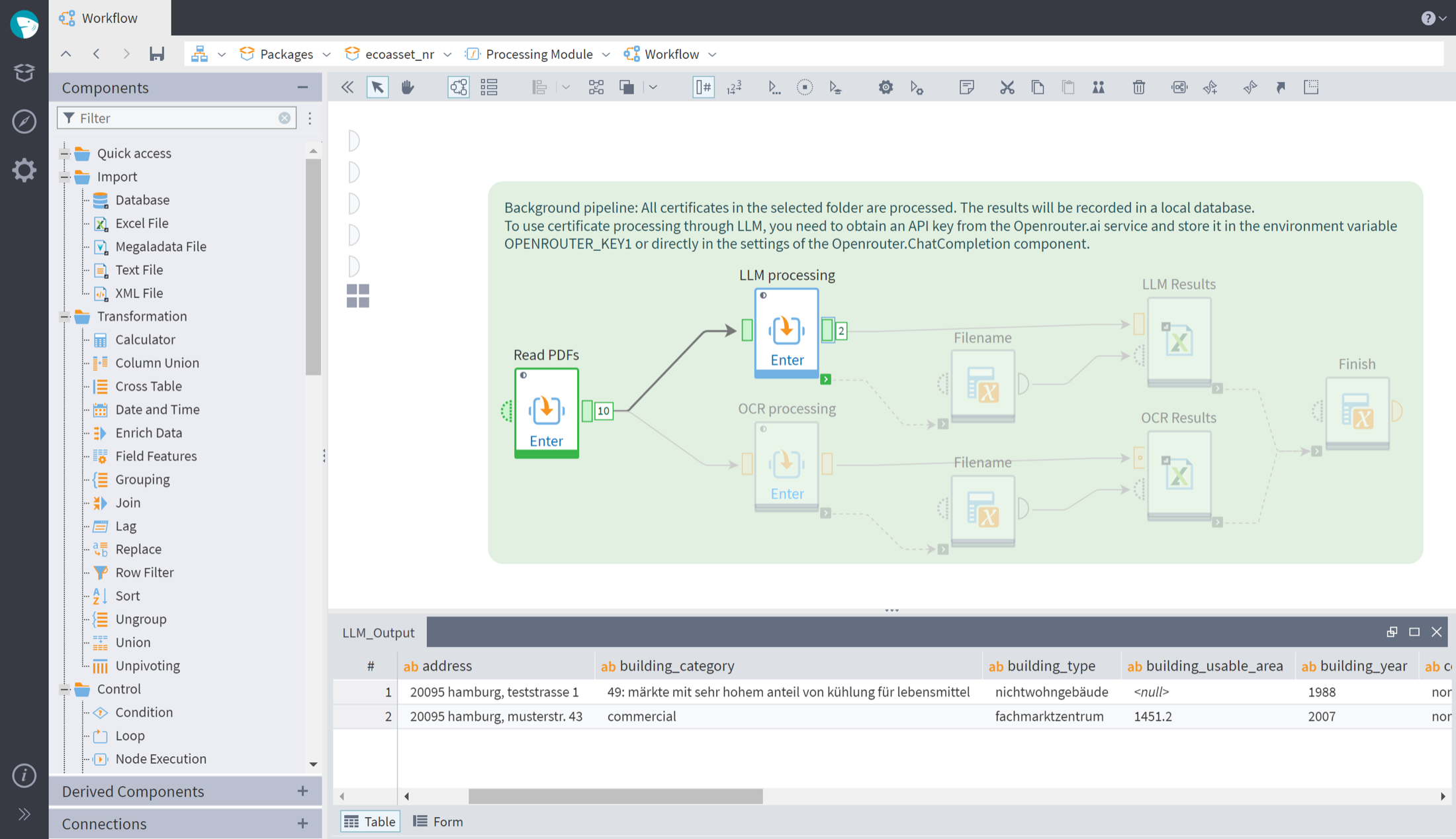

Eco Data Enrichment

AI-driven sustainability data retrieval and digitalisation for mortgage loans. Extracts data using OCR and LLM, searches via API

integration, and predicts missing data with machine learning.

Transforms non-digital or missing EPC data into a fully digital format. Crucial for regulatory reporting and improving your Green Asset Ratio (GAR)

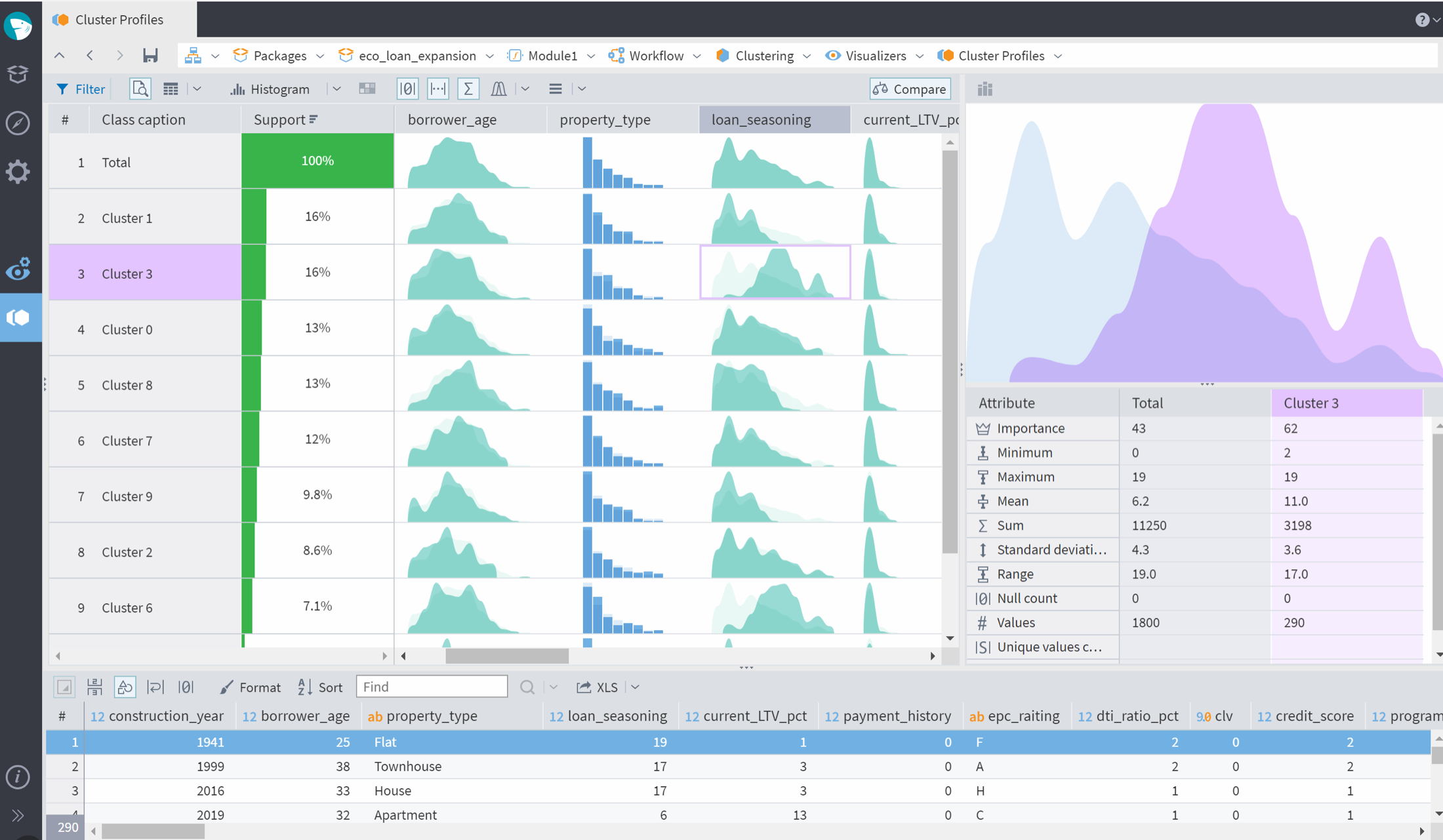

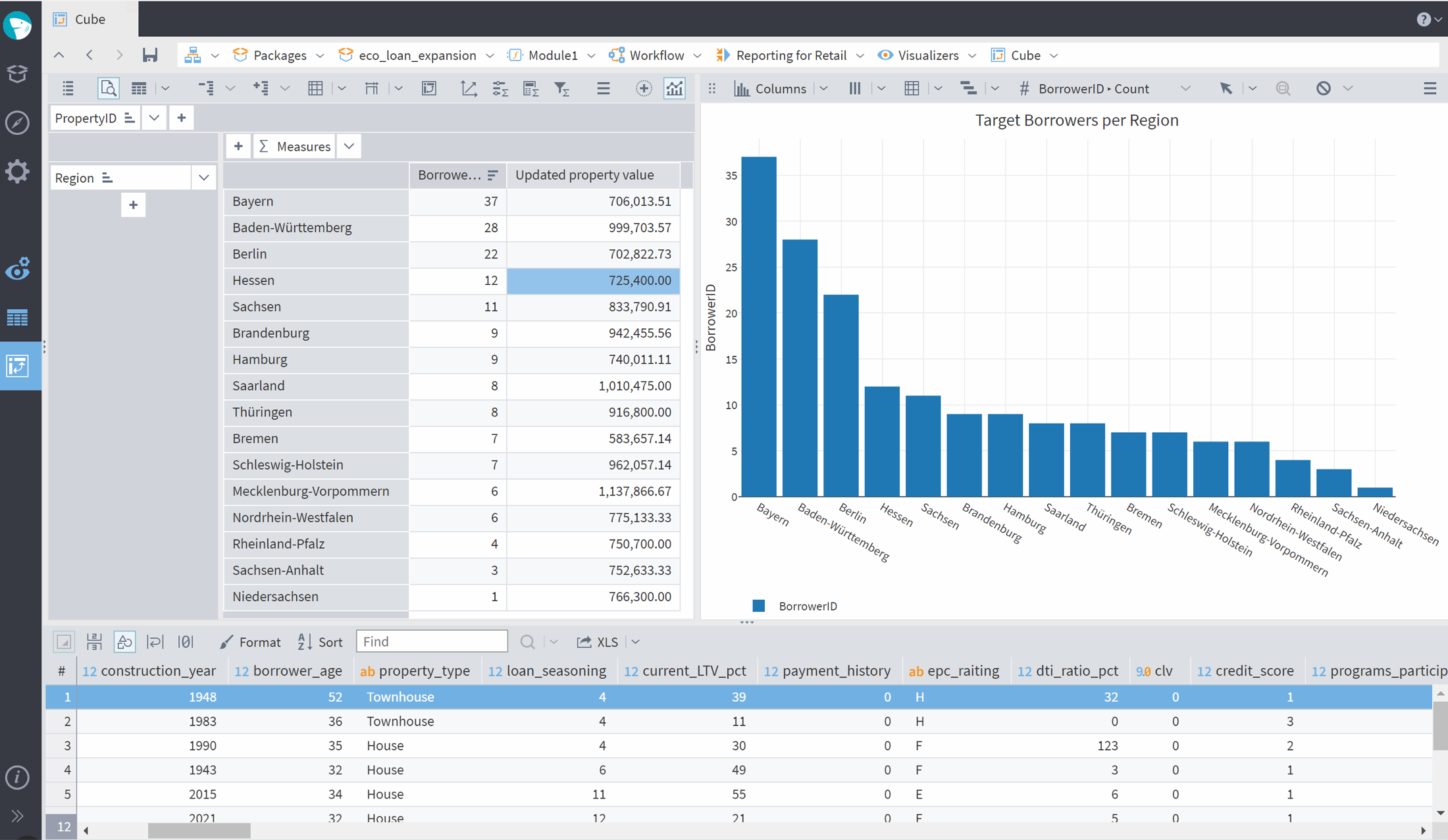

Eco Loan Expansion

Borrower segmentation and personalisation for sustainable loan top-up proposals. Includes customer segmentation, property value

uplift analysis (EPC-based VAP), and monitoring.

Identifies green cross-selling opportunities within your existing portfolio.

Risk-optimised Pool Management

Daily cover/collateral pool management, selection, expected loss analysis, and composition optimisation. Supports new business processing and existing portfolio management. Facilitates loan preparation, inclusion/removal from cover pool, collateral management, cover register management, coverage calculations, eligibility (e.g. according to the German Pfandbrief law), and stress testing.

A key feature is the automated generation of rating agency templates (e.g. Moody’s) and investor transparency reports (e.g. Harmonised Transparency Template – HTT).

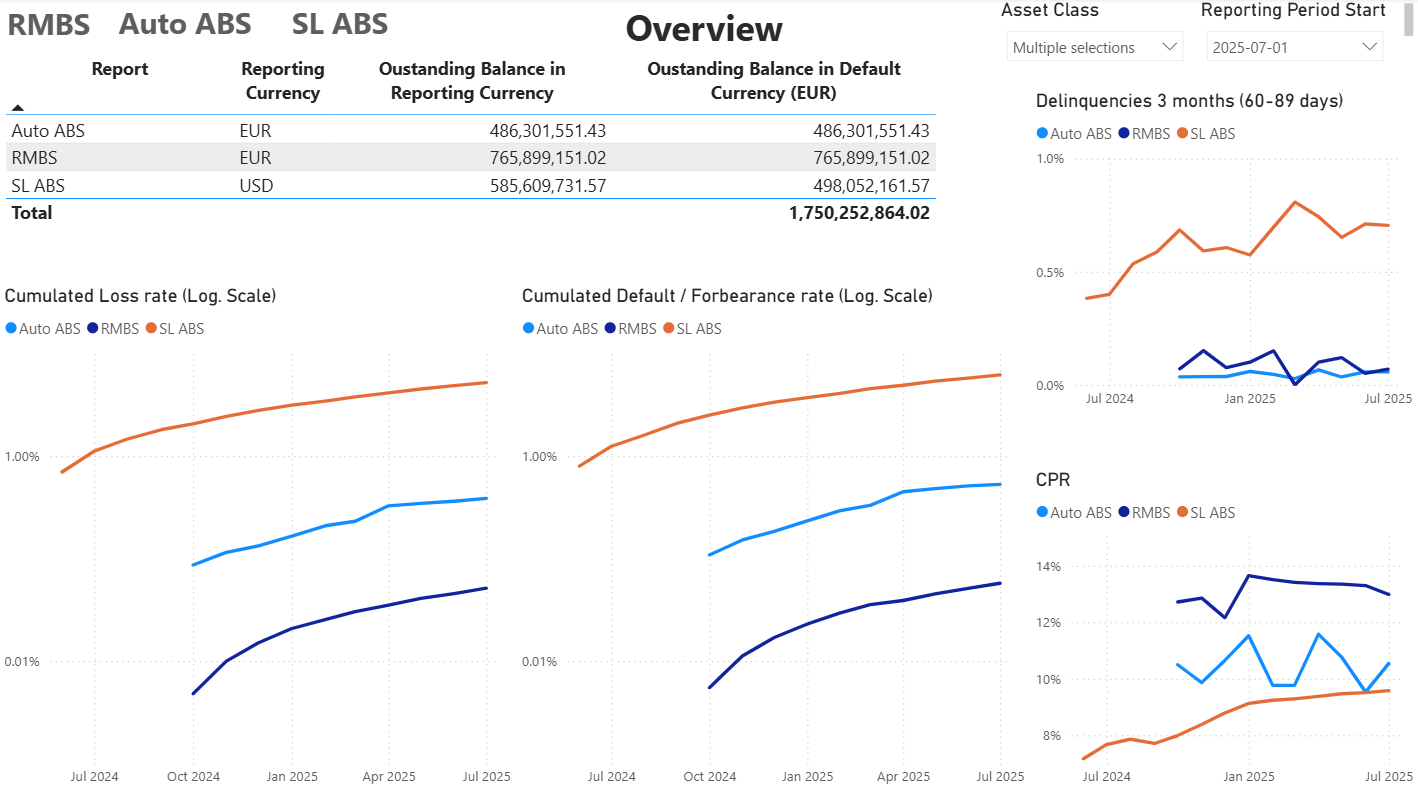

Securitisation Risk Monitoring

Tracks securitised asset pools across multiple transactions and asset classes

(e.g., RMBS, ABS, ABCP). Enables real-time risk monitoring, performance analytics, and early warning signals —

leveraging rating agency methodologies.

Powered by automated data extraction from investor and servicer reports, it supports comprehensive portfolio overviews, identification of deteriorating underlying assets, and detection of fraud.

Potential Impact Scenarios

Improved ESG Data Transparency for a Building Society

+40%

increasing GAR

A small German Building Society with a €2.4 bn mortgage pool digitised 100% of their EPC data using EcoAsset.AI, increasing their GAR

by

40% and issuing a new green bond. Manual pool data preparation for ESG reporting was reduced from 50% to just 10%

Full-Fledged Covered Bond Management for a Covered Bond Issuing Bank

-25%

risk weights

for mortgages

for mortgages

A mid-size Eastern European bank achieved a 50% funding cost reduction vs. senior unsecured by establishing a covered bond framework with

EcoAsset.AI. They reached 100% digitalised mortgage data and saw a 25% reduction in risk weights for mortgages, leading to 30% capital relief

Technology Advantage

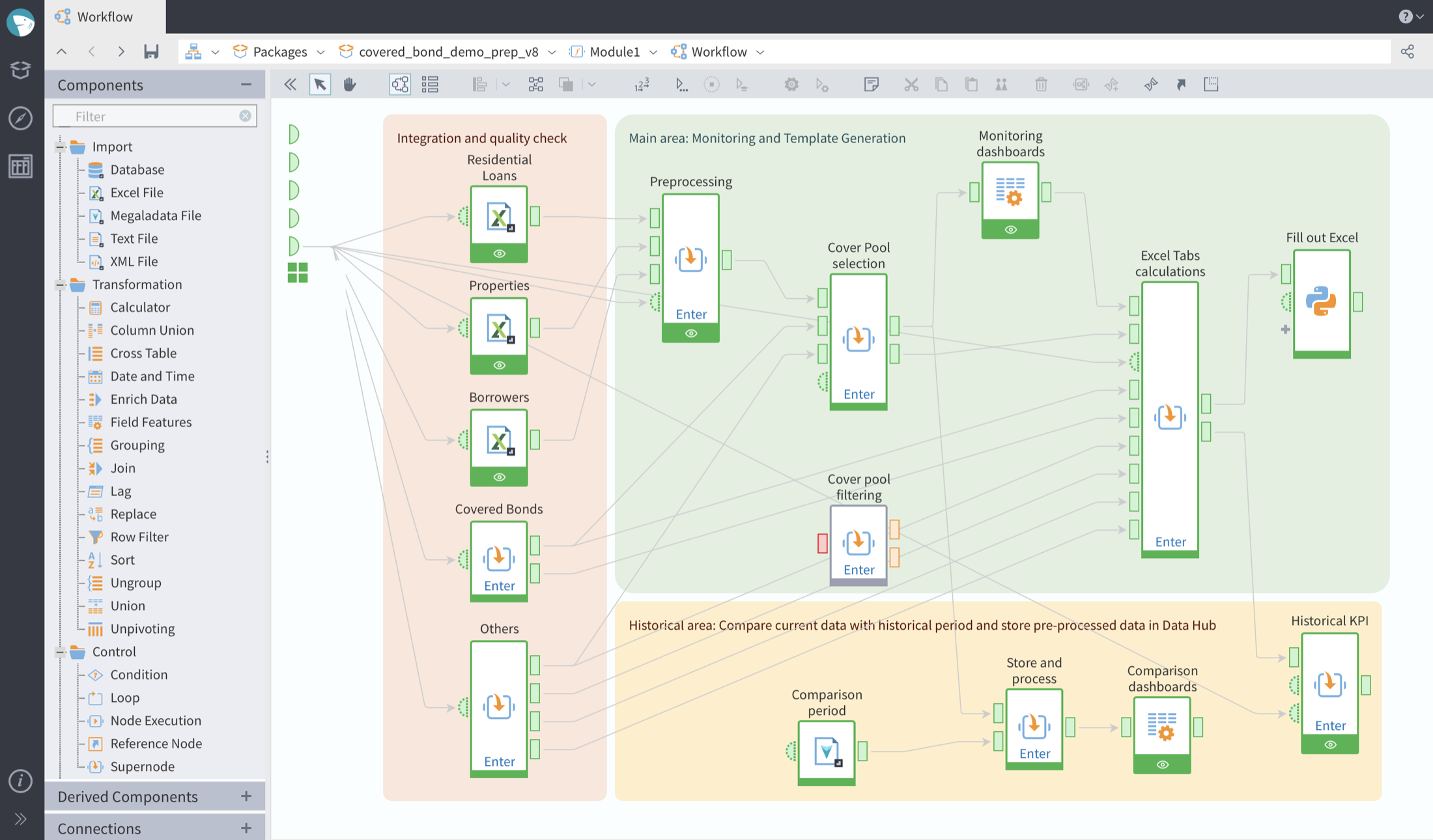

A web-based, user-friendly low-code interface designed for business users (no IT skills required). Seamless integration across 100+ sources. Provides lightning-fast

insights even with massive datasets (>100 Mln. rows). Available on-premises or cloud.

Workflow

We collaborate closely with each customer in an agile process — starting with the identification of real

business scenarios and defining the scope for data integration,

customisation, and tailored visualisations. After go-live, the platform is delivered via a subscription model, with ongoing expert support from our team.

PHASE 1

Initial Workshop

(Free)

Business scenario for EcoAsset:

- Modules

- IT infrastructure

PHASE 2

Integration Project

(Time & Material)

EcoAsset is working in a bank environment:

- Data is integrated

- Workflows are running

PHASE 3

Monthly Subscription

(Pay as you Go)

EcoAsset is fully life and used in production

Request a presentation

Please feel free to contact us.

We will hold a presentation and show

the product at a convenient time for you.

Or you can send us a letter to the info@adeal-systems.com

EcoAsset is a project from

ADEAL Systems

ADEAL Systems GmbH is a leading data and Al specialist,

providing innovative solutions for companies aiming to unlock new

business potential. In

collaboration with Megaladata, ADEAL Systems developed

Cusaas (Customer Segmentation as a Service), a solution designed for small and medium-sized businesses.

7+

Years in the Market

15+

Years Experience with Data

100+

Productive Data Projects